For clarification…

Pesos and Dollars both use the $ symbol. Pesos in Argentina is written AR$ or ARS and Dollars in the US is written USD or U$D. I’ve seen it written different ways than this, but these are the shorthands that I use. Many prices for big things are in USD.

I miss the simplicity of the United States

The credit card in your pocket helps make everyday transactions simple. When home and in Europe, I rarely carry much cash if any at all. But there are some places in the world where cash is the primary method. While in Morocco, everybody’s credit card machine was ‘broken’ at the time. Maybe it has more to do with them not wanting to pay taxes on their income.

In Argentina it’s a different reason. The Argentine government has made some weird currency restricts that I don’t understand. The part I do understand is that the number of rates at which I exchange my dollars for pesos are many. So when I go to exchange my money, I have to choose where to exchange my money based on who has the best rate.

So which rates do I choose from?

- Official Rate: This is supported by the government. If I exchange my money at any official stand, pull money out of and ATM, or pay with credit card. Current official rate is $1 USD = $150 AR$

- Blue Dollar Rate (Florida Street Rate): This is closer to the real market rate and is the black market rate. Since the government doesn’t crack down on this black market, it is nicknamed the ‘blue market’, hence ‘blue dollar’. If the government removed its weird currency controls, the official rate would move closer to this. This rate is much better to use as a tourist. You can find people on the street asking to change your money at this rate. Florida Street in the downtown area is full of these people exchanging money on the street. And yes, this is all as weird as it sounds. Current Blue dollar rate is $1 USD = $285 AR$. (You get almost twice as much money this way.)

- Western Union Rate: Something to do with the bond market. I don’t know what that means, I’m just repeating what a couple guys told me. Anyhow, this is usually a little lower than the Blue Dollar, but right now it is better even with the 2.5% transaction fees. Current Western Union rate is $1 USD = 306 AR$.

- CryptoCurrency Rate: This can be very convenient for locals because they can do it all from their phone and then transfer out of the country or to other people without the government getting involved. I don’t have a national id number so I am unable to open an account, so if I want to use this, I still must walk down to Flordia Street and find one of the few people that exchange Bitcoins for pesos. I haven’t bothered with this because although it historically has a better exchange rate than any other, it currently is the worst (besides the official rate, the official rate is ALWAYS by far the worst).

So when you come to visit us in Buenos Aires, remember some important rules that are the opposite of what you learned for traveling anywhere else.

- Never use your credit card

The credit card companies are forced to use the official government rate. So when you get here and pay for that cheeseburger, fries, and beer in pesos, VISA is force to convert at the terrible rate of $1 USD = $150. So your $1500 peso meal in a trendy downtown bar would cost $10 USD total. Not bad, but not good.

But if you decide to convert your money at the Blue Dollar rate, that entire meal will be converted at $285 pesos to the dollar, bringing the actual cost of the meal to $5 USD. Yes, $5.00 for a very good burger and beer in a cool downtown bar. The prices for eating out are crazy if you play the conversion rate game.

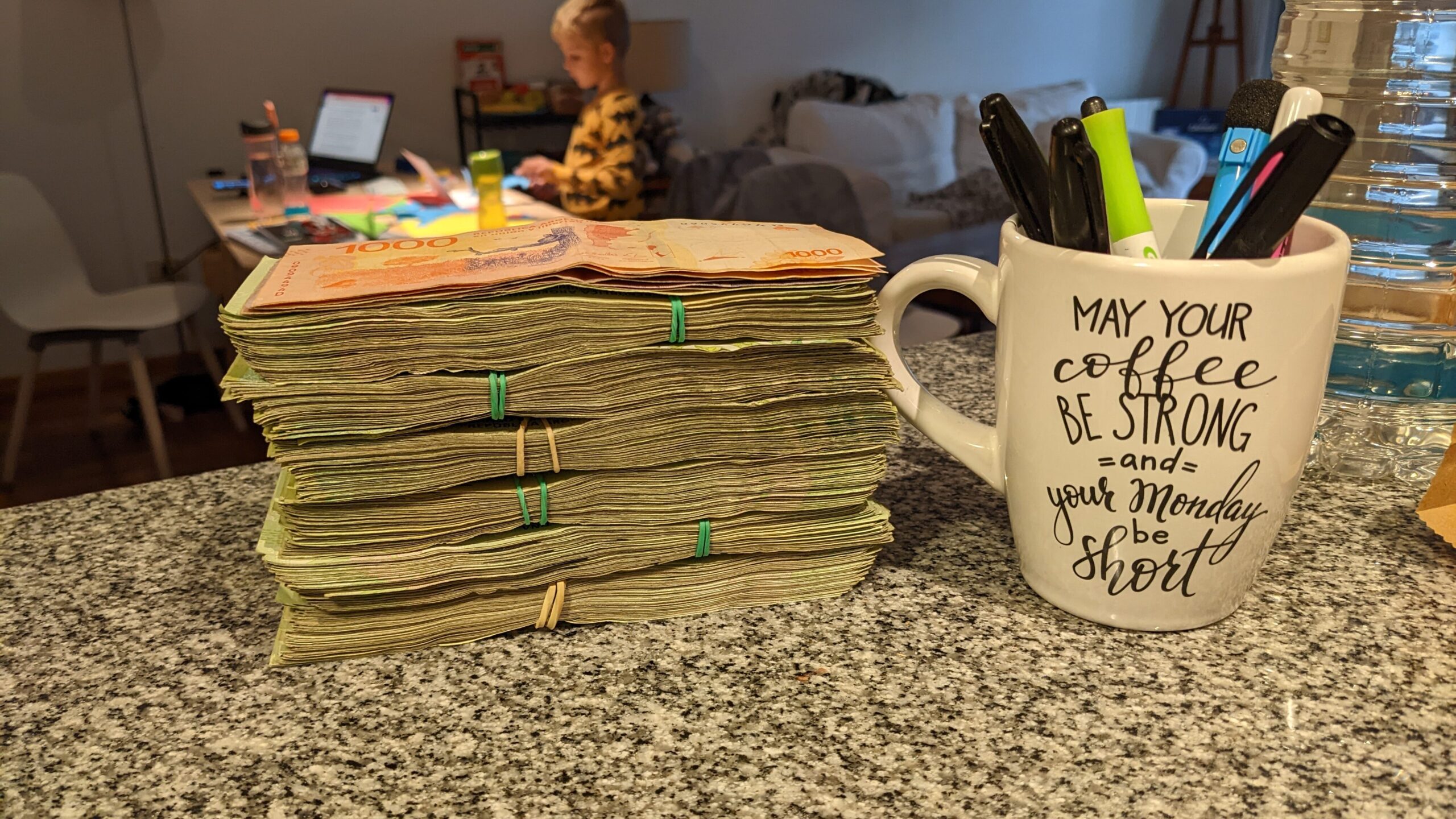

So how do you get the blue dollar rate or what I call the Florida Street Rate? Well, this is the second no, no when it comes to international travel to every other country. You must bring tons of cash with you on your flight. Since you can, but shouldn’t use credit card, you must bring cash for everything. The hotel stays, the car rental (if they let you), we plan to buy our flights around the country with cash.

2. Bring a ton of cash on the plane

So I call it the Florida Street Rate because the easiest way for somebody new in town to get this rate is to go down to the very touristy street named Florida. This street has lots of shops and legal places to change your USD to AR$. Don’t go to the legal store fronts because they will give you the official rate.

Instead walk down the street and every block or so you will see four or so people repeatedly saying, “Cambio, Cambio”. This means ‘change’ as in change currency. You can walk up to them and ask the going rate. Make sure its close to the rate published in the newspapers or any one of many websites such as https://bluedollar.net/ If you do a couple hundred dollars at a time, they might give you an extra peso to make you feel better, but it really doesn’t change much. Sometimes they will low ball you, so just let them know you know the going rate. I always seem to get one or two pesos below the going rate. I don’t know if that’s good or not, its just my experience.

The first time I changed money was kind of nerve racking. I found a gal calling ‘cambio’. She pulled out the calculator app on her phone and showed me the rate she was offering. I agreed and followed her to a kiosk selling flowers. Now this flower kiosk wasn’t really selling flowers, at least that wasn’t their main business. I walked to the back door of this little kiosk, my gal told the woman in the kiosk the rate we agreed upon, and the transaction was made. I counted the money and checked to see if it was counterfeit. All was good so I said ‘gracias’ and went on my way. It felt so weird to do a black market transaction so openly on the street.

3. Don’t use the ATM

For most countries, I don’t exchange money at the official exchanges or come with pesos from my bank back home. These usually have a lousy exchange rate or high fees. So it is almost always best to withdraw your money from an ATM. As with many other things, once again Argentina is the exception. Your ATM card will use the official exchange rate, so never use the ATM.

4. Crypto Currency is more than hype here

One of the best ways to get money into and out of the country is through cryptocurrencies. Because the government does a really lousy job managing the real currency, the Argentine people became early adopters to the cryptocurrency thing. But not with the hype investing reasons that people of the US did. They use it to avoid the habitual inflation the peso.

I don’t know the ins and outs of this method, because you need to be an Argentine citizen or temporary resident to use this method.

The method I currently use

So the first couple of times I took the metro down to Florida Street to convert my money. It’s a pain and takes a long time. Then I found that Western Union has better rates and are all over the city. So now I go there. But I don’t want to take out too much money, because inflation is so bad (average 5-8% per month and it even jumped 20% in one week earlier this year!). So now we exchange enough for a couple weeks and then go back for more.

When you come down here, just know that the money thing is a bit more work and more inconvenient, but if you play they game you can stretch you money a long way.